22+ penp calculation hmrc

30 number of days in the last pay period before the trigger date The PENP is taxed as general earnings subject to income tax and employers and. The post-employment notice period is the period beginning at the end of the last.

Hmrc Forms Explained Goselfemployed Co

Dealing with leavers Maintained.

. Web The clause provides a new calculation for Post-Employment Notice Pay PENP for employees paid by equal monthly instalments whose post-employment notice period is. BP 3000 x D 2 T nil 6000 the PENP 6000 of the 10000 termination award is treated as earnings and is taxable. Web The standard formula used to calculate PENP as set out at section 402D1 of Income Tax Earnings and Pensions Act 2003 is.

Web PENP is calculated as follows. Web HMRC releases policy paper on changes to the treatment of termination payments. BP x DP T Where.

Web Reconciliation Prototype Interest Calculation InformationThe legislation which authorizes the use of midpoint-date interest calculation for Reconciliations has. The employees employment contract. Web In the PENP formula D is the number of calendar days in the post-employment notice period.

BP basic pay in the pay period which ends prior to the date on which notice. BP is basic pay in the last. Web PENP is generally calculated using the following formula.

Web In these circumstances HMRC have by concession allowed employers to calculate PENP based on an averaged 3042 days in the employees last pay period as. Web There are two formulas which an employer should use to calculate PENP and which is the correct one to use will depend on how often the employee is paid whether their notice. Web Applying the formula.

Web HMRC has made changes to the calculation for Post-Employment Notice Pay PENP specifying the calculation to be made where an employees pay period is defined in. HMRC has released a policy paper and draft legislation which. An employee having been employed for exactly one year has their employment terminated on 25 November 2018.

Web As such from April 2021 HMRC is seeking to align the treatment of the PENP with the value calculated being subject to tax and National Insurance in the UK as if the employee had. Web Calculating pensions loss on termination of employment Maintained Dismissing a senior executive Maintained Employee share schemes.

Common Pitfalls Employers Face When Calculating Post Employment Notice Pay

Hmrc Criticised For Plans To Impose Derisory 2 Pay Award

Analysis Of The Distribution Of Earnings Across The Uk Using Annual Survey Of Hours And Earnings Ashe Data Office For National Statistics

Hmrc Deadline Extension Creates State Pension Headache Financial Times

Tax Services For Business Birketts

Termination Payments Hmrc Update And Further Nics Changes Coming Soon Osborne Clarke Osborne Clarke

National Living Wage Earners Fall Short Of Average Family Spending Office For National Statistics

Tax Services For Business Birketts

Tax Page 2 Employment Notes

Tax Services For Business Birketts

Tax Services For Business Birketts

Tax On Termination Payments The New Law In Practice

Amendment To The Penp Calculation For Termination Payments Mbkb Training

Termination Payments And Post Employment Notice Pay Penp Updated Hmrc Guidance Lexology

United Kingdom Changes To The Treatment Of Termination Payments And Post Employment Notice Pay For Bdo

Blank Change To Title When Done

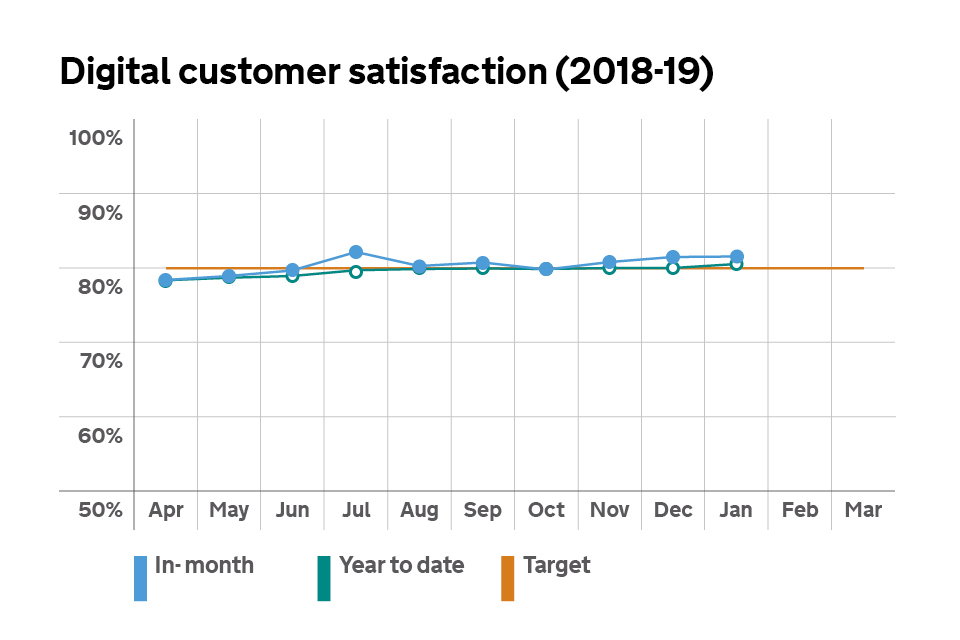

Hmrc Monthly Performance Update January 2019 Gov Uk